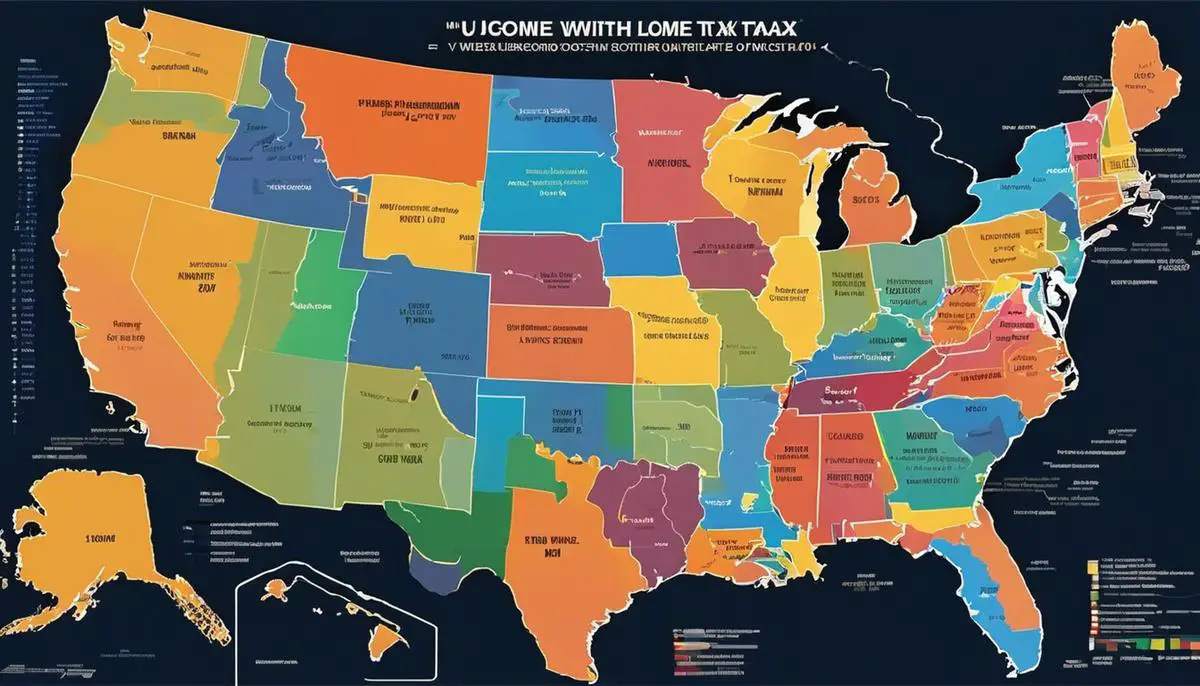

Unraveling the complex world of state taxes across the US landscape presents a revealing look into the socio-economic dynamics at play across the country. The denouement of this exploration offers insightful knowledge about states infamous for their high-income tax rates, leading to challenging conditions for businesses and entrepreneurs due to the sizable cut demanded by the government. On the other end of the spectrum lie the states that forego income tax, creating an entrepreneurial oasis and setting the stage for interesting fiscal contrasting realities. This analysis provides an opportunity to delve deeper into the delicate balance between tax rates, business climates, and average post-tax salaries in each state, enabling us to comprehend the broader implications on individual income and overall state economic health.

Tax Gehenna – The High-Tax States

Are you curious as to where you might want to start your next big venture or where to put down new business roots? The tax environment is definitely a consideration, especially now. Today, we’re talking about the states with the highest income tax rates.

While some states sport no income tax at all, others reach deep into the pockets of their residents. Here’s a look at the top echelons for individual income tax in the U.S. Keep in mind, this isn’t an argument for or against high taxes. It’s about understanding what it looks like across the country.

-

California: Topping the Income Tax League

California Black-tie meets surfer casual. Home of tech-savvy Silicon Valley and glamorous Hollywood. You get it all in the Golden State. But innovation comes with a price, here and that includes the highest marginal income tax rate in the nation – a whopping 13.3%.

-

Hawaii: Tropical Paradise, Hefty Taxes

Aloha! Vacation wonderland it might be, but living in Hawaii brings a hefty tax bill – 11% at the top end, to be exact.

-

New Jersey: High Income, High Taxes

The Garden State places third with its highest bracket hitting a marginal tax rate of 10.75%. New Jersey is one of the wealthiest states by median household income, but it does have a reputation for high-cost living.

-

Oregon: Enjoy the Views… and the Taxes

Oregon fits into this list at fourth, with a top marginal tax rate of 9.9%. Known for its diverse landscapes and eco-friendly vibe, Oregon takes its share from residents’ incomes.

-

Minnesota: The North Star State

The Land of 10,000 Lakes rounds up our list in the fifth spot. With a top income tax bracket at 9.85%, it’s clear that living in this northern gem can come with elevated costs.

In closing, if you’re thinking about expanding or starting your business, knowing the state income-tax scenario can be beneficial. There are always pros and cons to weigh. High tax states sometimes provide better public services and infrastructure which can attract a strong workforce. The tax environment in these states should not deter you from fulfilling your entrepreneurial dreams – it’s just one of many factors to consider when looking at the big picture.

Business Utopias – Zero Income Tax States

It’s well known that state income tax rates can greatly influence the financial health of businesses and individuals. There’s no denying the eclectic mix of states that impose the highest rates. However, there’s an opposite side of this coin that is truly intriguing – states that levy no income tax at all. These gems, hidden in the mosaic of United States’), equip the entrepreneurial spirits to not only be tax-efficient, but also live in dynamic, attractive locales.

There are currently seven states in the U.S. which impose no income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming. Additionally, New Hampshire and Tennessee only tax interest and dividend income. The reasons, benefits, and potential downsides of this policy vary from state to state, but general patterns do emerge.

States imposing no income tax often make up for this seemingly sizeable fiscal gap with other forms of taxation. That is, they have an ace up their sleeve. For instance, Florida’s absence of income tax is counterbalanced by a high sales tax. Texas counters its lack of income tax with relatively high property taxes. This kind of balance provides an innovative landscape for businesses, particularly those in related industries like real estate, retail, and financial services.

These states also attract an abundance of retirees due to their tax-friendly policies. With an aging population and longer lifespan, these demographics provide ample opportunity for growth in sectors like healthcare, technology, and leisure services. Additionally, states with no income tax have also been a symbol of entrepreneurship and risk-taking. Their incentivizing fiscal strategy tends to attract growth-minded individuals and dynamic businesses, generating opportunities for innovation and employment.

However, as with any entrepreneurial decision, it’s crucial to consider all variables. While the lack of an income tax can be beneficial, the elevated rates of other forms of taxation could impact the overall balance. Hence, astute entrepreneurs ensure clear-eyed calculation before jumping on the ‘no income tax’ bandwagon.

Additionally, keep in mind that tax is just one factor in choosing a location for business. Labor market, proximity to clients and suppliers, and availability of resources are equally, if not more important.

In conclusion, U.S. states with no income tax present a different yet equally fascinating side of the coin, as compared to their high-tax counterparts. They embody the spirit of entrepreneurship and offer a unique mix of benefits and challenges, painting a vivid picture of the U.S.’s diverse fiscal landscape. This variety and possibility define the market, and inevitably, the savvy individuals and businesses who dare to glass-ceiling-break and innovate. These states without income tax, in essence, are becoming incubators of enterprise and opportunity.

Comparative Analysis – High vs. Low Tax States

The other side of the equation is about those states with low or even no income tax.

In a way, they present the fascinating study of the other end of the Spectrum.

When we mention low tax states, Texas, Florida, and Nevada often come to the forefront.

With zero state income tax, these states are like magnets for businesses and individuals alike.

Taxation isn’t a one-size-fits-all scenario, and these low-tax states offer a unique insight into how different taxation models stimulate economic activity.

However, look closer, and one might realize it’s not simply open season for corporate giants or retirees.

A dearth of income tax invariably means higher reliance on other revenue streams such as sales tax, property tax, or taxes on specific industries.

Take Texas, for instance.

While it lacks a state income tax, it compensates with above-average property tax rates and sales tax.

Similarly, Florida holds a high rank when it comes to sales tax and depends substantially on tourism as its main income source.

A low-tax haven, you may wonder?

Consider the overall tax burden before you pack your bags.

Despite the attraction of no income tax, higher costs in other areas such as housing, property taxes, and sales taxes might even out the benefits.

Then there’s the question of who truly enjoys the fruits of this model?

Often, it’s the wealthier bracket of society that benefits from the zero income tax the most.

To counterbalance revenue losses, states tend to burden the middle and low income givers with the higher sales and property taxes.

Consequently, critics argue that low-tax states perpetuate wealth inequality.

These tax-free states also possess some allure for businesses.

Beyond just fiscal advantages, factors like strong infrastructure, a robust labor market, and the availability of vital resources are equally integral for entrepreneurs and businesses to prosper.

Yes, low to no income tax can be a significant lure, but the entire business ecosystem and overall living conditions prove equally influential in the decision-making process.

In conclusion, the contrast between high and low income-tax states uncovers a broader narrative than just the tax rates themselves.

It offers a clash between very distinct economic models and philosophies.

It’s about balancing growth and sustainability, individual and societal needs, the short term and the long term.

In it lies a lesson for businesses and entrepreneurs – a comprehensive understanding of these contrasts could be the key to successfully navigating the complicated seas of state taxes.

Predicting the Future – Impact of Tax Policies

As we traverse the complicated terrain of American taxation, it becomes abundantly clear that a deeper understanding of the alternative tax paths of states such as Texas, Florida, or Nevada, which impose little to no income tax, is key for businesses and individuals alike.

Keeping in mind these states’ unique models of generating revenue, they predominantly rely on alternative sources such as sales taxes, property taxes, and industry-specific taxes. This sort of economic approach is mindful of stimulating economic activity and fostering entrepreneurial spirit, showing potential for market expansion and innovation.

However, with every plan’s advantages inevitably comes its disadvantages. In this case, higher costs in areas such as housing, property taxes, and sales taxes might offset the benefits of having no income tax. Consequently, this taxation model may perpetuate wealth inequality by putting a disproportionate tax burden on middle and lower-income individuals.

This stands as a stark reminder that through the enticing fiscal advantages, one has to look beyond the superficial attraction of tax-free states for businesses. Other influential factors come into play, such as infrastructure quality, labor market fluidity, and the availability of resources that contribute to the overall business success.

Naturally, these diverse taxation models in states with high versus low or no income tax spur continuous debates. These discussions revolve around the clash of economic models and philosophies, casting a shadow of uncertainty and inciting careful projections into market trends.

Speaking of balance, one of the crucial focal points revolves around balancing growth and sustainability, short-term gains, and long-term societal needs. This presents a challenging but equally rewarding opportunity for entrepreneurs brimming with ideas and innovative solutions.

Thus, having a comprehensive understanding of these contrasting state tax approaches is pivotal for successful business navigation and enhancing personal finance management. Intricate complexity should not deter us but prompt us to seek knowledge and seize opportunities in a constantly dynamic business world. Finally, the reminder stands – adaptability, just like with evolutionary concepts, is key for the survival, growth, and success in today’s economic wilderness.

Through an in-depth examination of high and low tax states, one gains a comprehensive understanding of their variegated impact on the economic fabric of each state. These tax paradigms project the potential fiscal futures, shaping the context in which state economies, businesses, and residents will operate. From business migration trends to wage growth, tax policies act as an integral factor shaping these vistas. The pressing question that lingers is whether these states will maintain their status quo, fostering their existing economic environment, or adjust their sails to navigate future fiscal challenges. Income tax and average post-tax pay, thus, remain entwined script in this ongoing narrative of economic transformation across the United States.